Renters Insurance in and around Gretna

Gretna renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Your things are important; keeping them secure should be just as important. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your clothing to your guitar. Unsure how to choose a level of coverage? That's okay! Andy Van Horn stands ready to help you assess your needs and help select the right policy today.

Gretna renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Why Renters In Gretna Choose State Farm

Renting is the smart choice for lots of people in Gretna. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance may take care of water damage to walls and floors or smoke damage to the walls, that won't help you replace your possessions. Finding the right coverage helps your Gretna rental be a sweet place to be. State Farm has coverage options to accommodate your specific needs. Fortunately you won’t have to figure that out on your own. With empathy and reliable customer service, Agent Andy Van Horn can walk you through every step to help you develop a policy that protects the rental you call home and everything you’ve invested in.

More renters choose State Farm® for their renters insurance over any other insurer. Gretna renters, are you ready to talk about the advantages of choosing State Farm? Call or email State Farm Agent Andy Van Horn today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Andy at (402) 504-4265 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

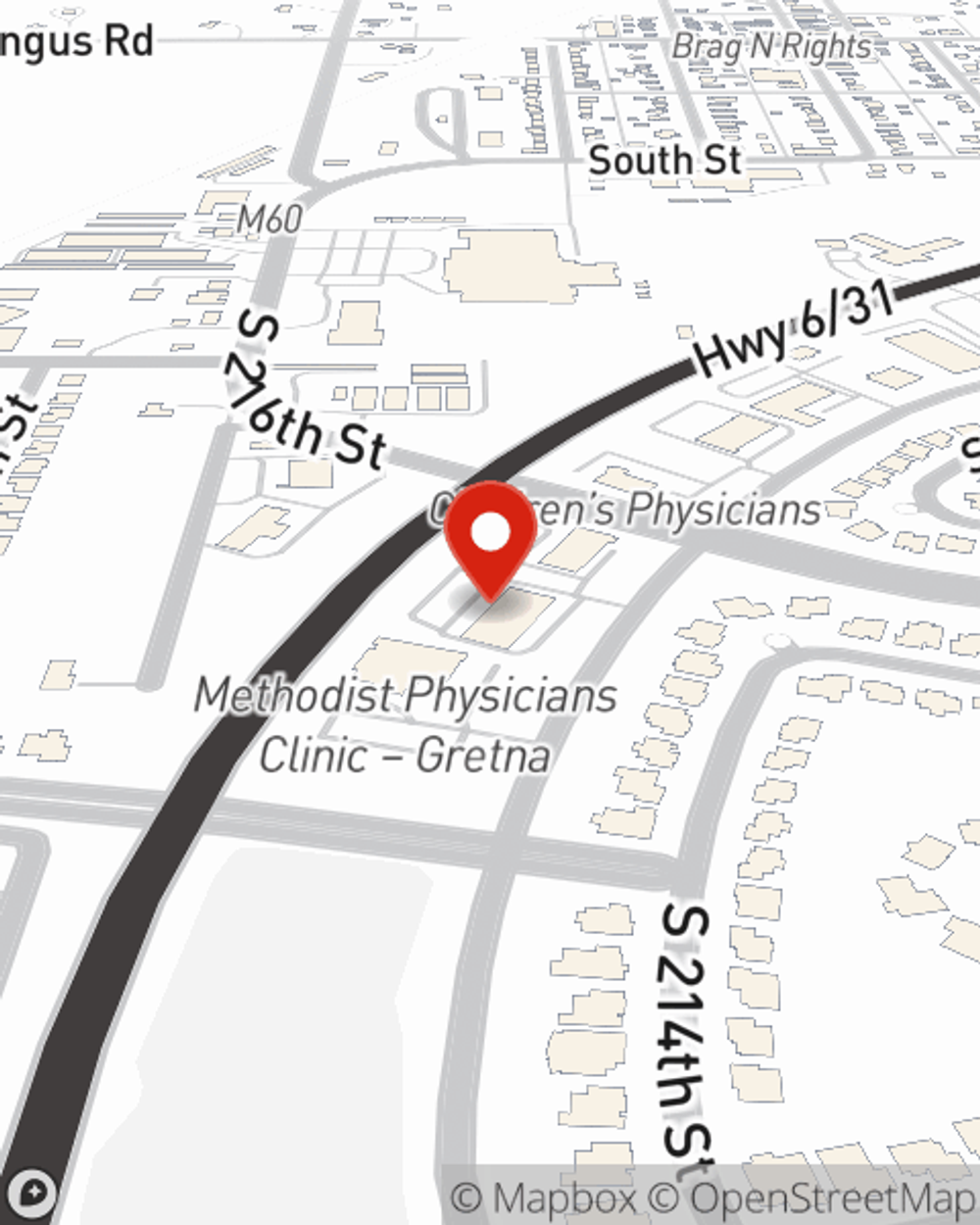

Andy Van Horn

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.